Medical Riders Premium and Insurance Charges Revisions

Medical cost has been increasing constantly in recent years due to the advancement of technology in medical field, the increase in hospital and doctor charges and the increase in usage of healthcare services. To support the higher payouts and to keep pace with the healthcare cost inflation and actual claim experience, Tokio Marine Life Insurance Malaysia Bhd. will make revisions on the premium/ insurance charges of the impacted medical plans effective from 1 January 2022.

Impacted policyholder will receive a notification about the revisions from us through email, SMS or mailed letter. Moreover, policyholders are recommended to sign up via Customer Portal to opt for electronic communications regarding any policy matters.

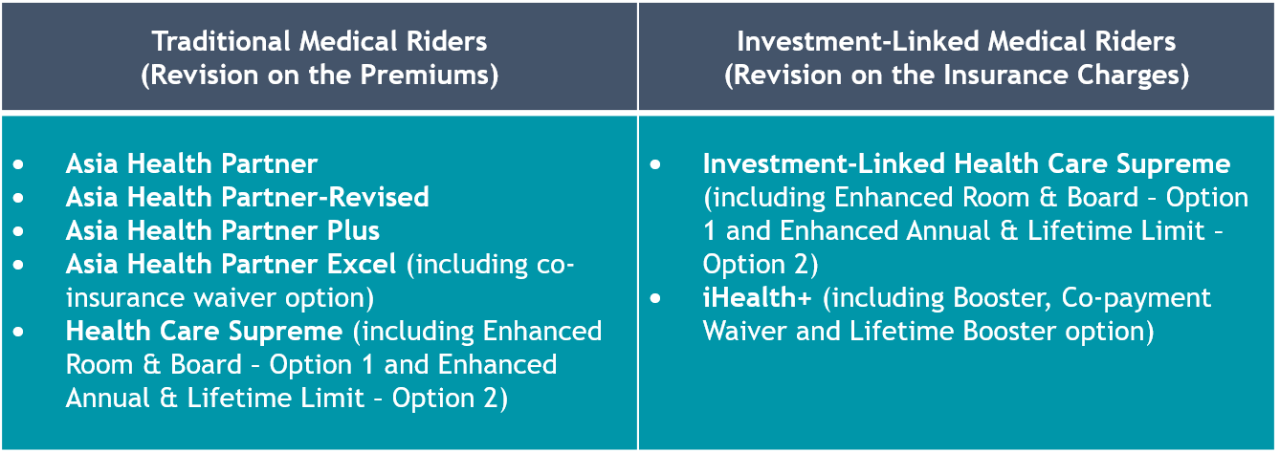

The medical riders that are affected are:

Additional Measure to Assist Policyholders Affected by Medical Rider Premium and Insurance Charges Revisions

In view of the current pandemic and our commitment to support our policyholders who are affected by Medical Rider Premium and Insurance Charge Revisions which is going to take effective from 1st January 2022 – 31st December 2022, we are pleased to announce that we are providing the additional measure below to assist these policyholders:

Temporary Change the Medical Rider to a Lower Plan Type and Switch Back to the Original Plan Type within the SAME Medical Rider WITHOUT Underwriting (“Temporary Change”).

The policyholder may change the medical rider plan type to a lower plan type within the SAME medical rider plan for an affordable medical coverage, provided that the lower plan type is available.

If the policyholder has performed this Temporary Change which takes effective between 1st January 2022 and 31st December 2022 and wants to switch back to the original medical rider plan type later, we will accept the application to switch back to the original medical rider plan type WITHOUT any underwriting within 12 months period from the effective date of this Temporary Change.

The waiting period of the medical rider will NOT be applied after the original medical rider plan type is switched back.

Other Options

Besides, the policyholders may also consider other options below:

1. Revise Premium Payment Frequency

The policyholder may change to pay the premium more frequently, e.g. from annual payment to semi-annual/quarterly/monthly payment to reduce financial burden. The premium amount may will be adjusted based on the modal factor for the revised payment frequency.

2. Apply for Premium Deferment Program. For more details, please visit Tokio Marine Life Corporate Website.

We hope this additional measure can assist you in this challenging moment.

You may refer to the FAQ here for better understanding on this additional measure.

FAQ for Additional Measure To Assist Policyholders Affected by Revision of Premium/ Cost of Insurance/ Insurance Charge for Medical Riders

Have queries? Speak to our friendly agents

If you require assistance from us regarding any matter, please contact us by clicking on ‘Contact Us’

Disclaimer

By clicking on “Continue to external site” below, you will leave Tokio Marine Insurance Group’s website and you will be redirected to a third party website.

Choose your country or region

Visit HQ Pages

Visit Country Pages

Select your location and language

-

All

-

All

-

Asia Pacific

-

Australia

-

Americas

-

Europe

Singapore

Malaysia

Australia

You are currently on a site outside of your country Switch to external site?

Visit your local page. If you change your mind, you can use the dropdown at the top navigation to visit other Tokio Marine country pages.

You are currently on a site outside of your country. Switch to local site?

Visit your local page. If you change your mind, you can use the dropdown at the top navigation to visit other Tokio Marine country pages.